Struggling to figure out how long it’ll take to pay off your credit card? Wondering how much interest you’re stuck paying—or how extra payments could save you money? Our Credit Card Payoff Calculator with Extra Payments is here to help! This free, easy-to-use tool takes the guesswork out of debt repayment, showing you how to speed up your payoff and cut down on interest costs. Whether juggling a big balance or just wanting to get ahead, this calculator is your go-to solution for smarter financial planning.

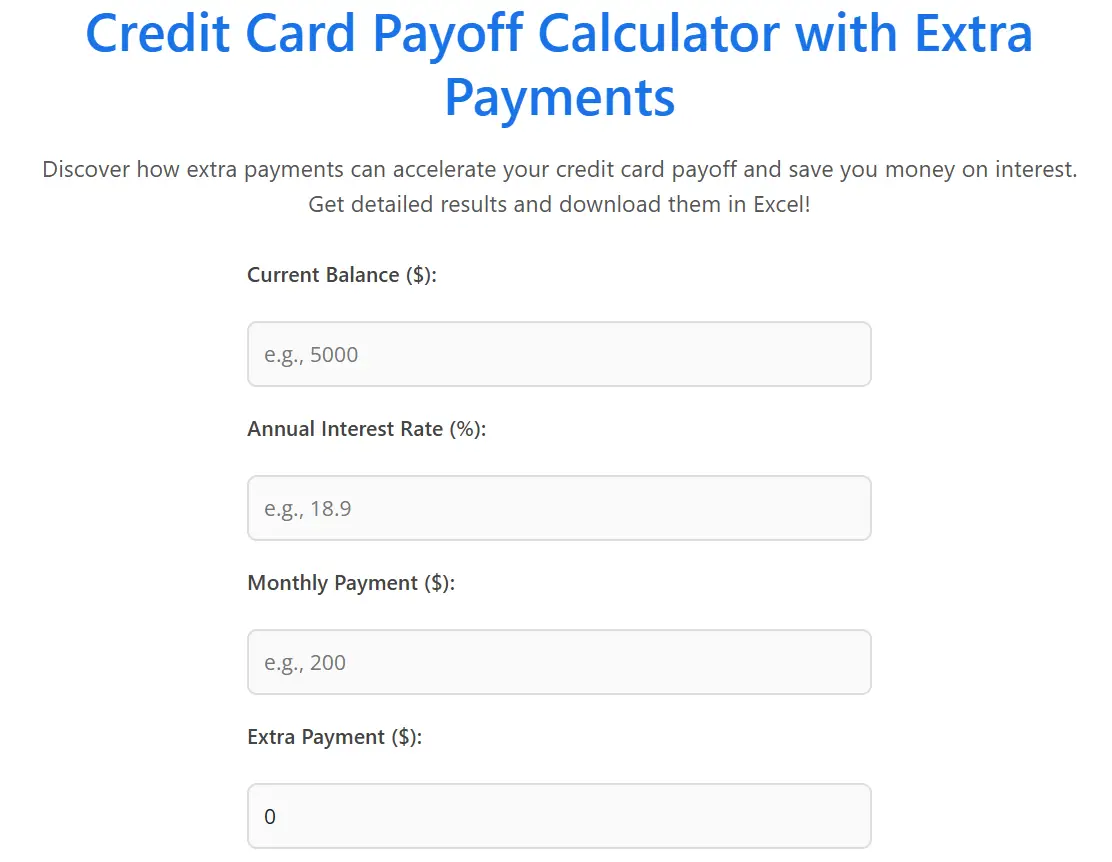

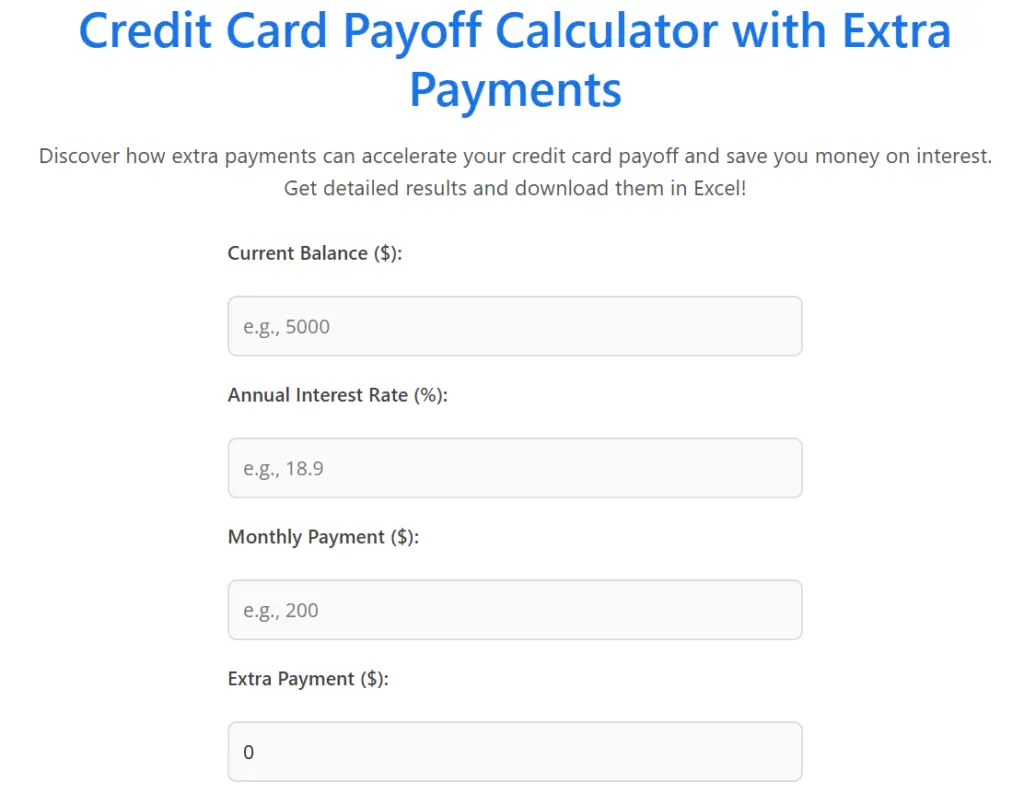

Credit Card Payoff Calculator with Extra Payments

Discover how extra payments can accelerate your credit card payoff and save you money on interest. Get detailed results and download them in Excel!

What Does Credit Card Payoff Calculator with Extra Payments Do?

Imagine having a clear roadmap to becoming debt-free. That’s what this calculator delivers. You simply enter your current credit card balance, annual interest rate (APR), monthly payment, and any extra payment you can afford. In seconds, you’ll get a detailed breakdown of:

- How many months does it take to pay off your card?

- Total interest you’ll pay over time.

- A month-by-month table showing your balance, interest, and payments until you’re debt-free.

Plus, you can download your results in Excel to keep track of your progress or share with a financial advisor. It’s like having a personal debt coach—without the hefty fees!

Why Extra Payments Matter

Here’s the secret banks don’t want you to know: even small extra payments can slash your payoff time and save you hundreds (or thousands!) in interest. For example, adding just $25 or $50 a month to your regular payment can knock months off your debt timeline. Our calculator proves it with real numbers tailored to your situation. You’ll see exactly how much faster you can be debt-free and how much cash stays in your pocket.

Who Should Use This Tool?

This calculator is perfect for:

- Debt warriors in the USA are looking to pay off credit cards quickly.

- Anyone curious about how much interest their credit card is costing them?

- Budget planners want to test extra payment strategies.

- People who love data and want a downloadable payoff plan to stay motivated.

Whether you’re tackling a $1,000 balance or a $10,000 mountain of debt, this tool works for you—no complicated math required!

How to Use the Credit Card Payoff Calculator with Extra Payments

It’s as easy as 1-2-3:

- Enter Your Details: Input your balance (e.g., $5,000), APR (e.g., 18.9%), monthly payment (e.g., $200), and any extra payment (e.g., $50).

- Hit Calculate: Watch the magic happen as the tool crunches the numbers.

- See Your Plan: Get a detailed table of your payoff journey, plus expert advice on how to save even more.

Don’t like what you see? Play around with the extra payment amount to find a plan that fits your budget. Then, download your results as a handy Excel file to keep on track.

Real Example: Save Big with Extra Payments

Let’s say you owe $5,000 with an 18.9% APR and pay $200 monthly. Without extra payments, it’ll take 32 months and cost you $1,346 in interest. Add $50 extra each month, and you’re done in 25 months, paying only $1,012 in interest. That’s 7 months faster and $334 saved—just by tweaking one number! Our calculator shows you this step-by-step, so you can plan with confidence.

Why Choose Our Tool?

- 100% Free: No hidden fees or subscriptions.

- Modern & Simple: A clean design that works on your phone or desktop.

- Detailed Results: See every month’s progress in an easy-to-read table.

- Excel Download: Take your plan anywhere.

- Expert Tips: Get personalized advice to pay off debt smarter.

Boost Your Finances Today

High credit card debt doesn’t have to drag you down. With our Credit Card Payoff Calculator with Extra Payments, you’re in control. Find out how quickly you can ditch that balance, save on interest, and free up cash for the things you love. Ready to take the first step? Try the tool now and see how extra payments can transform your financial future!

Related Tools

Advanced Credit Card Tracker Tool

Ultimate Credit Card Tracker – Smart Expense & Payment Manager (Excel)

Credit Card Utilization Calculator

Frequently Asked Questions (FAQs)

How does the Credit Card Payoff Calculator with Extra Payments work?

It’s simple! Enter your credit card balance, interest rate (APR), monthly payment, and any extra payment. The tool calculates your payoff timeline and interest costs, showing results in a table. You can tweak the extra amount to see how it speeds things up.

Why should I make extra payments on my credit card?

Extra payments reduce your balance faster, cutting down interest and payoff time. For instance, adding $50 monthly can save hundreds and shave months off your debt. Our calculator shows you the exact savings based on your inputs.

Can I download my credit card payoff plan?

Yes! After calculating, click “Download Results in Excel” to get a CSV file with your month-by-month breakdown. Open it in Excel or Google Sheets to track your progress or adjust your budget.

Is this credit card payoff tool really free?

Absolutely—it’s 100% free with no hidden fees. We built this tool to help you manage debt without costing you a dime. Just plug in your numbers and start planning!

What’s a good extra payment amount to start with?

Start small—$25 or $50 works for most budgets. Test different amounts in the calculator to see what fits. Even a little extra can make a big difference in paying off your credit card faster.

How accurate is this debt payoff calculator?

It’s highly accurate, using your exact balance, APR, and payment details. The month-by-month table reflects real interest calculations, so you get a reliable plan to follow or share with a financial advisor.